Know your market — MBO vs MBP Datafeeds

This article will show you the main kinds of available data feeds and the aspects that differentiate CFD from Legacy Futures markets.

Newbie traders often decide to get their hands dirty right after learning to recognise a couple of price patterns on a chart. But are they aware of the underlying mechanisms related to the instruments of choice?

Many rookies, when they start their trading journey, don’t even know what an order book is; figure out if they’re aware that different brokers can provide various kinds of data feeds and that not every Datafeed is equal to each other.

This article will show you the main kinds of available data feeds and the aspects that differentiate CFD from Legacy Futures markets.

Want to trade Crypto Derivatives with high liquidity and low fees? Try WOO X now!

MBO

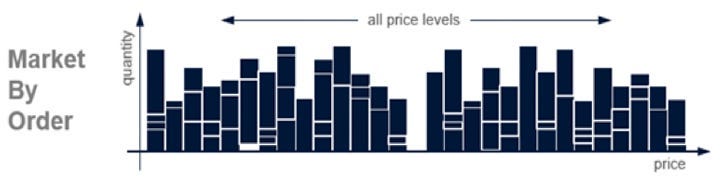

MBO stands for Market by Order. A Datafeed can be classified this way if it enables the final user to visualise:

The position in queue when placing a limit order;

Full market depth;

The total number of limit orders and their size at each price level.

It is the kind of Datafeed offered by dxFeed, Denali, CQG and Rithmic in the Futures markets (CME, EUREX and CBOE).

The major crypto exchanges such as Binance, FTX, BitMex and Bybit also offer this kind of Datafeed, which is why it’s possible to read order flow and Delta in this kind of market. Even if we get a partial picture of what’s happening due to volume fragmentation, but that’s a topic for another article.

An MBO Datafeed grants more transparency, putting the trader in the right place to understand the underlying market dynamics that make the price move. The position in the queue is determined through OrderIDs that the system assigns.

The following image from the CME group makes it possible to see an example of the ES order book, MBO kind.

You can easily spot the total liquidity at each level as well as the fragmented contract size in an anonymous way.

The MBO Datafeed allows the trader to make a complete analysis which includes the available liquidity, volumes and Delta, on top of the classical PA analysis.

MBP

MBP stands for Market by Price. It’s a kind of Datafeed that restricts the market depth visibility up to 10 price levels and shows only the total quantity of Limit orders, which are not fragmented per size. On top of that, viewing the position in the queue is impossible when placing a Limit order.

This kind of Datafeed is usually offered by an intermediary who gives derivatives from the symbols available via an MBO Datafeed, offering a less detailed vision than the original feed.

This is an example of the ES on an MBP-based order book. It’s immediately possible to see how the vision is blurred, dumbing down everything to a vague summary of the total quantity of orders resting on the limited, visible levels.

Do you want to try now a highly customisable and easy-to-use trading platform for doing order-flow and AMT analysis on the futures markets?

Check now VolSys and VolBook from VolumetricaTrading! Use the following coupon: FRL10DS to receive a 10% discount at the checkout!

Both VolSys and VolBook are compatible with Savius Limitless challenges! Use the coupon code lazor50 at the checkout to receive a 50 EUR discount on your Limitless challenge!

Contracts for Difference

Since I wrote about stuff offered by an intermediary in the realm of non-MBO data feeds, why not touch on non-regulated trading instruments?

Welcome into the realm of CFDs, then.

CFDs, or Contracts for Difference, are derivative contracts from an underlying asset -usually a Future contract or a stock- offered by various authorised Brokers. These contracts enable the trader to profit from the underlying asset’s price movements without owning it.

This infographic explains the mechanism behind CFDs.

When trading CFDs through a broker, the trader can usually see the price history and the actual best buy / best sell price at a minimum spread determined by the Broker.

It’s impossible to see the order book with all the resting liquidity. However, the Broker can see these pieces of info, putting them in a position with an unfair advantage compared to the traders that pass through them. The Broker can see the liquidity and the order flow on the contracts they offer, using this as an edge for balancing their positions on the original underlying assets.

About trading volumes, it’s possible to derive them on CFDs via tick volume indirectly.

Vantages and disadvantages

When traders operate on an MPB Datafeed or CFD instruments, they cannot rely on order-flow-based info, basing their trading behaviour only on a statistical edge derived from the pure PA analysis.

Those who operate directly on the Futures markets with an MBO Datafeed available can also count on the order-flow-derived Infos, having more pieces of info to use coupled with the PA for deriving a statistical edge.

When traders operate on derivative contracts, it must be considered that it can be tough to be profitable with scalping and day trading due to the spreads eroding a statistical edge that would make them profitable otherwise on the regulated markets.

On the other hand, CFDs are a quick and easy way to access multiple trading instruments with high leverage, without any other burden.

The traders can also take advantage of the high leverage, counterintuitively, as a risk management tool, avoiding depositing too much capital on a single Broker. All in all, it’s an excellent way not to be too exposed to potential Black Swan events that could involve the same Broker where you’re taking your trading endeavours.

TLDR

MBO stands for Market by Order. This acronym refers to a Datafeed offering a complete order book vision.

MBP stands for Market by Price. This acronym refers to a Datafeed where the order book vision is limited. Usually, it’s offered by an intermediary.

Contracts for Difference, or CFDs, are derivative contracts which usually are offered to the trader by a broker who lets the trader see only the best buy and best sell price at a given spread. The resting liquidity is not visible to the trader but to the Broker.

Closing words

Traders’ profitability is tied to their system’s statistical edge. To gain an advantage, a trader must deeply know the fundamental baseline characteristic of their trading instruments, starting from the provided Datafeed. If you don’t know which data you have at your disposal, you might be ignoring some layers of analysis that could play a role in your strategy.

The more transparent a market is the more readable layers from all the traders that are active in that specific market.

Suppose you pretend to trade a derivative contract without considering that an underlying asset — with a readable MBO Datafeed type — influences its price movements. In that case, you’re putting yourself at a clear disadvantage. You might want to consider it.

Want to trade Crypto Derivatives with high liquidity and low fees? Try WOO X now!